Basic data of Argentina

The total population of Argentina is about 44.5 million. In 2018, the country suffered financial storm and the pressure of US dollar interest rate rise, which made the peso of local currency seriously devalued. The local inflation rate soared to 56%, which led to a negative growth rate of - 2.515% in GDP growth in 2018. Although Argentina has completed the presidential election in October this year, and the rulers have decided to change, the outside world still holds a pessimistic view on the future market In the future, GDP growth rate may continue to be explored.

In terms of climate, Argentina is located in the southern hemisphere, with four distinct seasons. In the south, it has a cold climate. In the south, it is close to the polar region, and the winter temperature is generally below zero, with an average temperature of about 6.3 degrees. In the middle, it has a subtropical and temperate climate, with a mild climate. In the north, it has a tropical climate, with a maximum temperature of over 40 degrees in summer and an average temperature of 21.6 degrees. Argentina has sufficient sunshine resources, and the average daily illumination per square meter can reach about 5.6kwh.

Development of renewable energy in Argentina

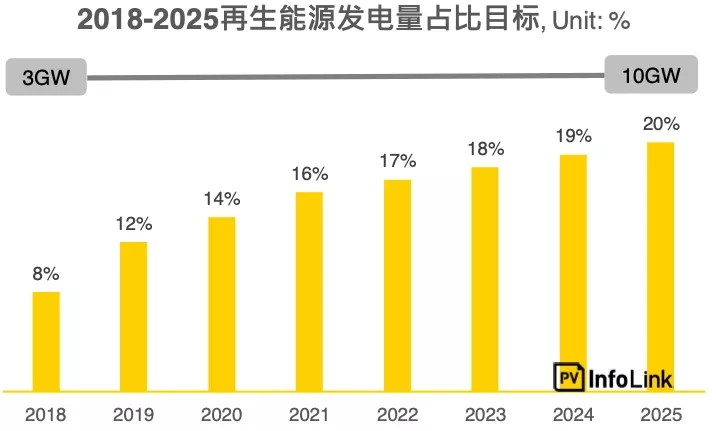

In September 2015, Argentina's Energy Commission adopted Law No. 27.191 to establish the renewable energy development goal. The law stipulates that the 20% renewable energy power generation proportion will be achieved by 2025, and the 10GW cumulative renewable energy installed capacity goal will also be achieved. In the planning of renewable energy, photovoltaic and wind power will be the main projects to promote the development of the industry.

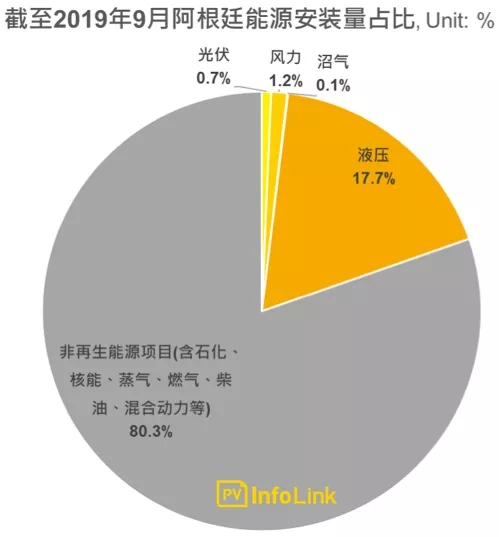

At this stage, the local energy use is still dominated by non renewable energy projects, accounting for about 80% of the total installed capacity. Among the renewable energy, the best development of hydraulic projects accounts for about 17% of the total installed capacity, while the proportion of photovoltaic, wind power and biogas is still very small, accounting for about 3% of the total.

Photovoltaic policy and industry development in Argentina

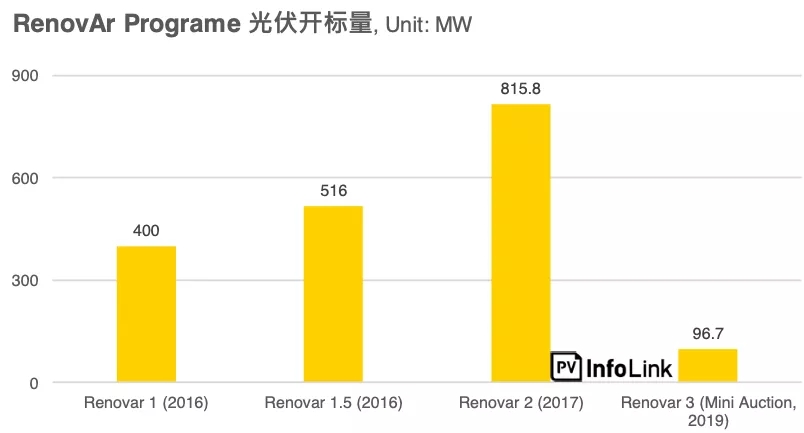

With the establishment of renewable energy target in the second half of 2015, the Argentine government began to take action. In 2016, renovar program was released to stimulate the development of the industry. In photovoltaic projects, five rounds of renovar program have been held so far, with a volume of about 1.8gw. These projects have signed a 20-year PPA for power purchase with cammesa, the power retail regulatory authority, and are expected to be completed in 2018-2022 Grid connection. In the last round of bidding, RENOV Ar3 is limited to less than 10MW, so the open scalar is lower than the first three rounds.

On the other hand, in order to promote the popularization of green electricity, the government grants consumers the freedom to choose green electricity suppliers and enjoy the rights and interests to negotiate green electricity contracts independently, and regulates that those with an average annual power consumption of more than 300 kW need to use a certain proportion of green electricity (applicable to 12% in 2019). If they fail to comply with the regulations, they will be punished by paying a fine.

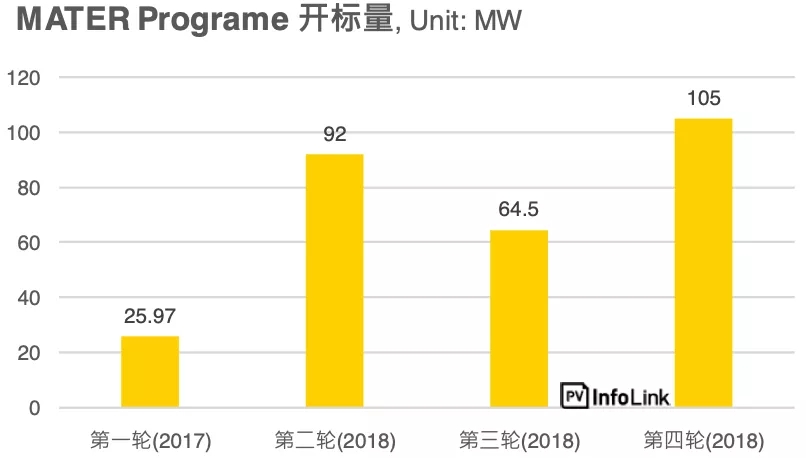

In order to ensure the smooth implementation of this policy and assist consumers to meet the demand of power purchase, the Mercado a terminal de Las Energias renewables – material framework was officially released in 2017. In addition to reducing the barriers to purchase green electricity, the material also includes holding bids to sign private PPA. So far, four rounds of material bids have been held and about 287MW bidding volume has been issued. These projects have been generally signed for 10 years Power purchase PPA for.

As for the promotion of distributed projects, in addition to allowing the grid connection of surplus electricity, this year the government released a tax credit plan for distributed projects with a scale of less than 2MW. For every 1kW project installed, 15000 Bissau (about US $250) tax credit certificate can be obtained, with a maximum of 1 million Bissau for each project.

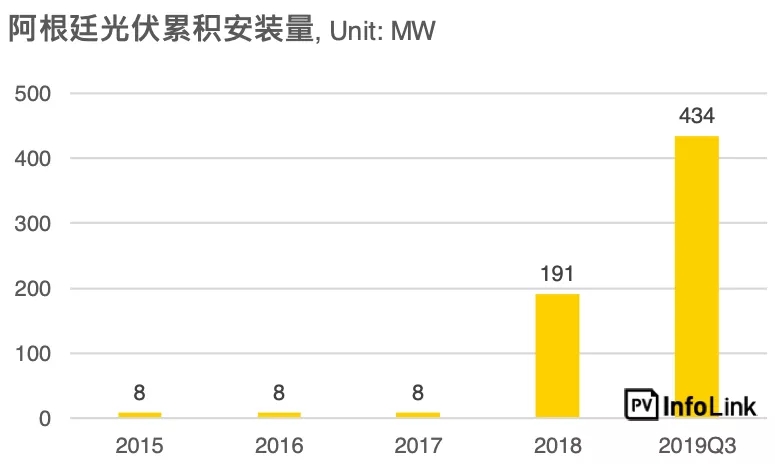

Focusing on the photovoltaic demand, the demand has not been reflected before 2018, so the market can be said to be in a state of stagnation. Under the incentive of competitive projects, the installed heat in Argentina has begun to increase. In 2018, the cumulative installed capacity reached 191mw, a huge growth compared with only 8mW in 2017, and the market began to enter the growth stage. By the third quarter of this year, the cumulative installed capacity has increased to 434mw, This year's demand is hotter than last year's.

Import and export analysis of Argentine components

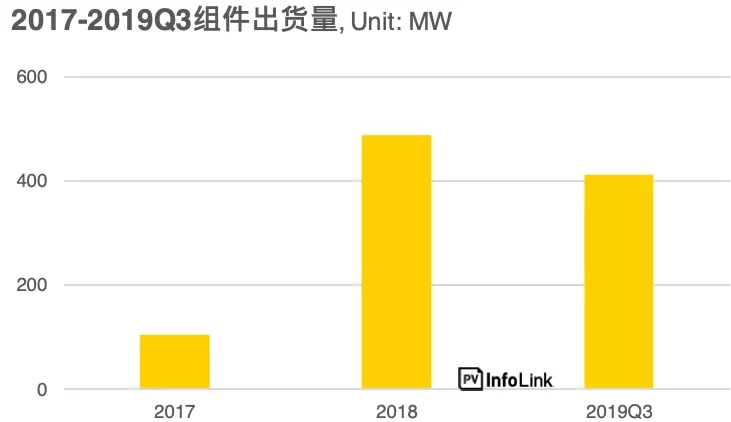

Since 2018, the number of components shipped from China to Argentina is about 480 MW, with a significant increase compared with the shipment volume of about 100 MW in 2017. By 2019, the demand for shipment is even stronger. The total shipment volume from the first quarter to the third quarter has reached the level of 410 MW, and this year's shipment volume is expected to surpass last year's performance.

Since 2018, the shipment volume has greatly increased, and most of these components are estimated to be used to meet the demand of bidding projects executed in the past.

conclusion

Argentina plans to achieve 20% of renewable energy power generation in 2025, and achieve 10 GW of cumulative renewable energy installed capacity. It remains to be seen whether the new government will make changes to the original energy plan after the recent presidential election.

In recent years, under the stimulation of competitive projects, Argentine photovoltaic industry, which has been stagnant for a long time, has started to enter the growth stage. In 2018, the cumulative installed capacity reached 191mw, a huge growth compared with 8mW in 2017. By the third quarter of this year, the cumulative installed capacity has increased to 434mw, and the demand this year is hotter than last year.

The same phenomenon can be reflected in the shipment volume of components. Since 2018, the number of components shipped from China to Argentina has been about 480 MW, a significant increase compared with the shipment volume of about 100 MW in 2017, and the shipment performance is better in 2019. The total shipment volume from the first quarter to the third quarter has reached the level of 410 MW, and this year's shipment volume is expected to break through last year's results. Most of these components are estimated to be used in renovar and material bidding projects completed in recent years.

Finally, in recent years, Argentina's economic situation is not good. Last year's annual GDP has fallen to - 2.515% of negative growth. This year's prosperity seems to have no sign of warming up. Whether it will affect the projects that have not been built at present and the future development of photovoltaic industry still needs continuous attention. Whether the new government can save the economic downturn or whether it will be able to maintain long-term and stable growth of Argentina's market